Future of Money: Where will Blockchain take us next?

Fiat currency is not the only form of money now. As technology is advancing on an everyday basis, it is changing the way people can now manage fundamental tools of finances. It is now an old story when people contacted banks for mortgages or reached ATMs for physical cash.

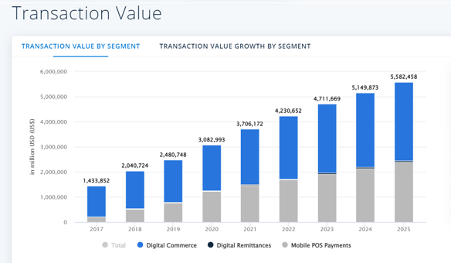

Amid the COVID19 pandemic, Asia Pacific alone saw a huge hike in digital payments all across. According to Statista, in 2020 and 2021, the total number of digital payment transactions reached 3,082,993 and 3,706,172 million, respectively.

In this period, we witnessed huge financial transactions that were purely online based. And thus, it is safe to say that the future of money exists in digital formats. However, it is just the beginning of the future as we are in an early stage of digital financial transactions.

The recent concept of money is transforming through cryptocurrencies as well. Decentralized and backed by blockchain technology, digital currency is now challenging all financial institution, that is currently managing all financial tools around the world.

Digital currencies like Bitcoin and Ethereum saw a huge escalation in price in the year 2021 and shaped to bring remarkable progress in 2022 as well.

Analysts and experts define the future of money in two categories: Fintech Innovations & Blockchain Technology.

Cryptocurrency & Blockchain Technology

As most people are already aware, cryptocurrency is a digital token that is transferred and secured using blockchain technology. Bitcoin, which is known to be the first decentralized digital currency was launched in 2009 and holds the biggest market value and popularity in the industry.

At the beginning of 2022, the market cap of Bitcoin was valued at $786 billion as many people are already investing in BTC. According to Coinmarketcap, the estimated value of cryptocurrencies is almost $2 trillion.

However, cryptocurrencies have always been in controversies and a debatable discussion among financial analysts. That is because cryptocurrencies are not tied to any sovereign institution or financial regulator.

As we dig more in detail, cryptocurrencies are also being utilized for money laundering and buying illegal goods from restricted regions. But despite a pessimistic approach, Cryptocurrency might soon become a significant disruptor to the global economy.

Many corporations and countries are already on the edge of calculating financial rewards associated with cryptocurrency. So, let’s figure out some of the associated trends with cryptocurrency that are under practice already.

Cryptocurrency Trends

Many experts and analysts have predicted that in the next 3-5 years, cryptocurrencies will be used for retail payment as many financial institutions and applications are accepting Bitcoin as a mode of payment. Many industries are already using cryptocurrency as a mode of payment.

- Gambling Industry: Online gambling industry was one of the first verticals to accept cryptocurrencies as a mode of payment. There are various Bitcoin casino sites that offer major benefits as punters gamble and make successful payments with digital bridges. As a matter of fact, cryptocurrency holds an extraordinary power as it is majorly because of decentralized currency that users can gamble on casino sites from almost every part of the world.

- Tourism Industry: People like to go away on holidays from their busy schedules and routine. Since there are restrictions on financial transactions when making a payment outside the country, cryptocurrency will soon be accepted as a relief.

Without access to ATMs or whooping interest on cashing credit card amounts, tourists find it impossible to enjoy leisure activities in different countries using just the bank card. Since crypto payments are done with just a few clicks on a smartphone, many restaurants and leisure places are already considering digital payments with crypto.

Hedge Against Inflation

According to Gartner, the adoption of cryptocurrency will be realized by investors as a hedge against inflation and an alternative investment portfolio, replacing commodities like Gold and Fuel. Many companies are now interested in investing in cryptocurrencies to achieve better mobility towards decentralized finance (Defi).

Since popular cryptocurrencies like Bitcoin and Ethereum are highly volatile, they are claimed to beat the inflation and rising prices of goods to retain value. For instance, if the value of essential goods like milk and wheat rises, Bitcoin perhaps can beat the inflation cycle.

Crypto’s value multiplies and give humongous returns in just a span of one year. However, there is a downside to the same when Bitcoin or other currencies witnessed a sharp fall.

Central Bank Digital Currency (CBDC)

As the popularity of cryptocurrency peaked in the past few years, many central banks considers unveiling their legitimate digital currency called Central Bank Digital Currency (CBDC). This digital format commits to better transaction speed without associated risks.

CBDCs represent 90% of global GDP right now. A country like China has distributed more than $5billion worth of ‘digital yuan’ to its population in 2021. Ironically, it is the same country that banished miners to mine all forms of decentralized currencies.

Meanwhile, the Indian government is still improvising ways to tax cryptocurrency while the central bank develops its digital format. Citizens having direct accounts with the central bank is one option to implement CBDC. This would provide governments with strong new tools for controlling the economy, allowing stimulus funds and other benefits to be directly credited to citizens.

Customer Loyalty Reward Programs

Speaking of the currency rewards programs issued by banks and financial institutions, consumers feel obligated and frustrated to use them. These loyalty points come with their terms and constraints that ultimately leads to disappointment for most people.

With such a frustrating process, users are now more comfortable with the online shopping experience. This increases returns of e-commerce sites and businesses where they can engage customers with more flexible reward points.

Blockchain Technology & E-commerce

Amid the COVID-19 pandemic, we learned how to utilize the best of our time and ability by making a successful purchase while sitting at home. Not only it was convenient but saved a lot of effort and hassle while the virus looked for new heads every day.

To make this experience more flexible and transparent for users, many businesses are now adopting blockchain technology and rewarding consumers with whooping discounts.

Since the volatility of BTC and other coins is quite high, the online shopping experience can bring much more benefit than just your favourite item in the digital cart.

Non-Fungible Token (NFT)

Non Fungible Token is a very innovative blockchain-based asset. NFTs are the digital counterpart of a one-of-a-kind piece of artwork that is valued at a large amount of money. NFT counterpart can be anything: an artwork, a picture, a real estate property or simply a tweet.

NFTs work by tokenizing the respective asset in the digital algorithm to the digital paperwork of the asset. Many people are very little aware of the value of NFTs right now, but this digital vertical can propel into the highest value industry pretty soon.

NFTs are also expected to transform into a strong marketing tool. In the coming years, innovative enterprises might ‘auction; digital use rights for intellectual property in different industries like social media, manufacturing, sports, and financial services.

Stablecoins

Stablecoins are digital assets backed by real-world assets like commodities, fiat currency, gold, or other digital assets. They are the outcome of early crypto investors' quest for digital fiat currency alternatives that will keep their value over time.

Stablecoins' value does not vary as much as other cryptos like bitcoin or ether, and they may be made stable by computer algorithms.

Stablecoins are digital assets with a fixed value, similar to fiat money, but with the usefulness and mobility of a cryptocurrency. Simply put, they serve as a link between volatile cryptocurrencies and stable fiat currencies.

Metaverse

Metaverse is the next-generation virtual reality version of the digital world. In the coming years, Metaverse might become a fully functioning marketplace where users can purchase products in virtual stores using cryptocurrencies.

Facebook has already placed its biggest bet with an elaborated marketing campaign about Metaverse, and of course, by remaining themselves as META!

With the help of different technologies including Blockchain, Metaverse will an extraordinary virtual reality to live the original life of physical space with virtual space. However, the concept is still cloudy and analysts are still trying to find out the connection between virtual space and cryptocurrency.

Role of FinTech Companies in Blockchain Industry

As the technology is advancing everyday, FinTech firms continue to thrive the digital economy by serving specialized engineering products as part of the digital transformation. TransforHub, being one of the leading product engineering firm evaluates the potential usage of blockchain technology.

The firm specializes in serving full suite around technologies including blockchain, IoT, cybersecurity, Augmented Reality, and Artificial Intelligence. The digital transformation is the future of tomorrow, and TransformHub blends with unique strategies to thrive the same. The end to end solution partnership is what you experience across the transformation process as transformHub’s partner.

For additional details on how we can elevate your company’s brand, connect with the specialists at TransformHub at sales@transformhub.com

Share this

You May Also Like

These Related Stories

Importance of technology in the vast spectrum of investment domains.

The Top Digital Transformation Trends That Will Shape 2023