EAI for BFSI: API INTG Approach, Design & Archt

API integration is critical for the success of an organization, but it's not as overwhelming as it's made out to be. Once you figure out a strategy to align it with your business goals, it creates a great opportunity to grow, open new revenue streams, maximize customer value, and fulfil all your digital business initiatives - such as opting to go for banking industry solutions from a recognized digital transformation company. Having discussed at length about Open APIs and their role in the banking sector, we now move on to look into the nitty-gritties of API integration, mainly from the design and architecture perspective.

The approach to API integration

There is an intimate connection between the business goals of an enterprise and the technical challenges it faces while achieving them. Communication on these aspects therefore should be clear for architects to understand and build a viable interface. Care needs to be taken to ensure a clear focus is maintained while designing the interface and deploying an API infrastructure so as to build apps that can render maximum value to end-users. Siloed databases and applications need to be opened up and greater functionality must be offered blurring organizational boundaries for greater efficiency and collaboration.

The modern customer is looking for better experiences and greater personalization. Sectors including BFSI and fintech service providers are pushing the envelope for exceptional user experience. Explains Hardayal Prasad, MD, and CEO, SBI Card, “We have been investing heavily in our technology infrastructure, including AI, ML, and digital platforms. Fifty percent of our accounts go without the intervention of underwriters. Our chatbot has a correctness of 97 percent, which is among the highest in India’s BFSI sector.”

The need for offering better customer experiences and access to finance industry solutions, especially during the ongoing pandemic which requires BFSI and other sectors to go digital to the core, we are now moving towards partner integrations too. If you are looking at a similar growth chart, our IT consulting services can be of help.

The API design

It is easier to build an effective API ecosystem if it addresses the main questions that include but not limited to:

- Who are we building it for?

- What are the apps that need to be built?

- What systems and assets are being exposed?

- Who are the target developers?

This will help build relevant APIs - both private and open - for internal and external use.

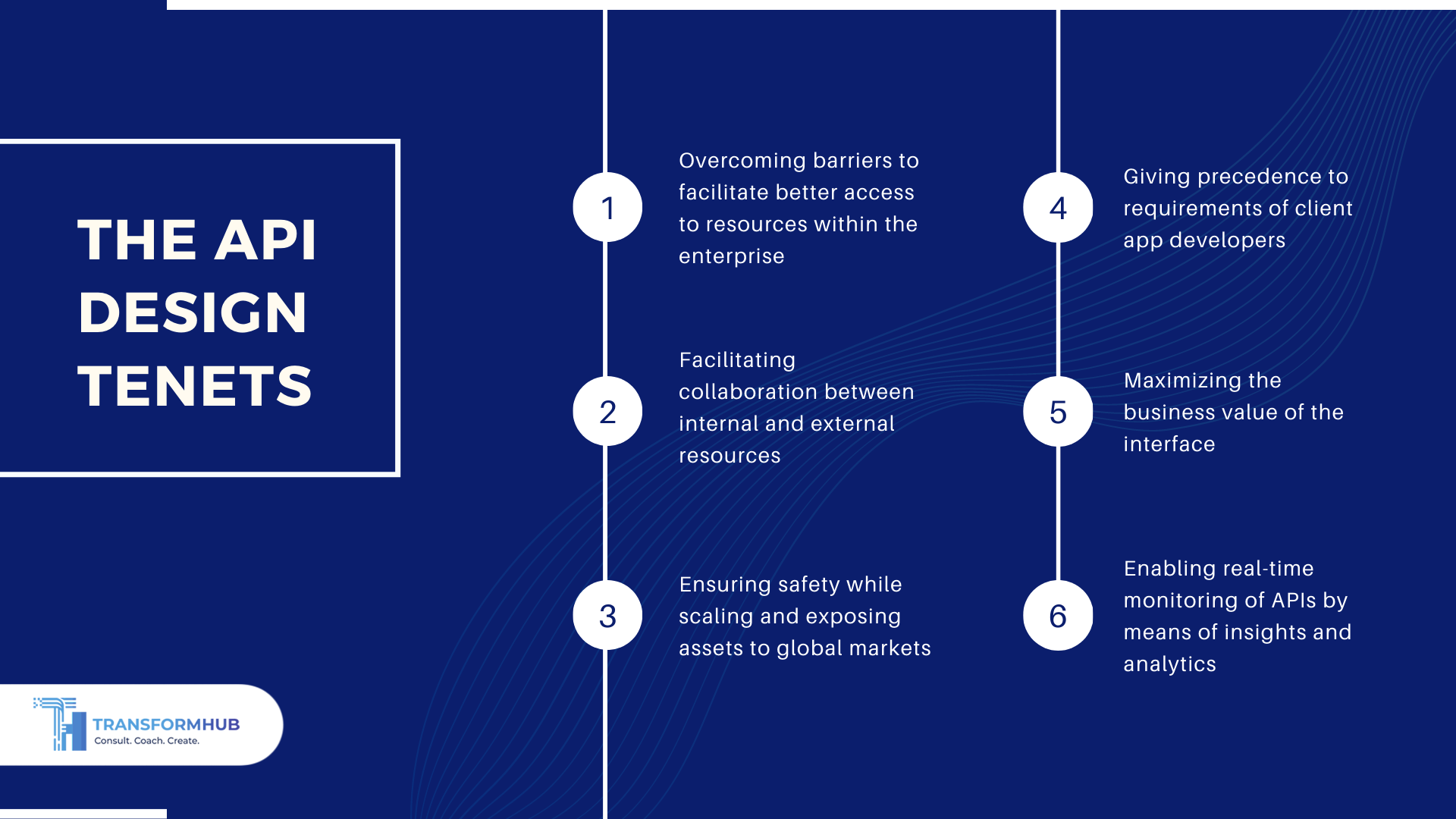

The design should be built to address the following areas:

- Overcoming barriers to facilitate better access to resources within the enterprise

- Facilitating collaboration between internal and external resources

- Ensuring safety while scaling and exposing assets to global markets

- Giving precedence to requirements of client app developers

- Maximizing the business value of the interface

- Enabling real-time monitoring of APIs by means of insights and analytics

More importantly, the focus has to be on building a robust value chain that connects all business assets including backend systems, API providers, app developers, client apps, and end-users to offer greater business value and ensure technical efficiency.

A well-integrated API will:

- Generate greater revenue especially in the case of pay-to-play applications

- Ensure greater customer reach and value since customers get to enjoy existing services via new platforms and vendors

- Offer an immersive experience helping enterprises push their products and services via engaging content weaved in with best online marketing practices

- Stimulate technical innovation by enabling developers to implement new ideas without changing backend systems

A good API design will call for strategies that factor in costs, resources, efficiencies, value, revenue, and business innovation.

What is a good API architecture?

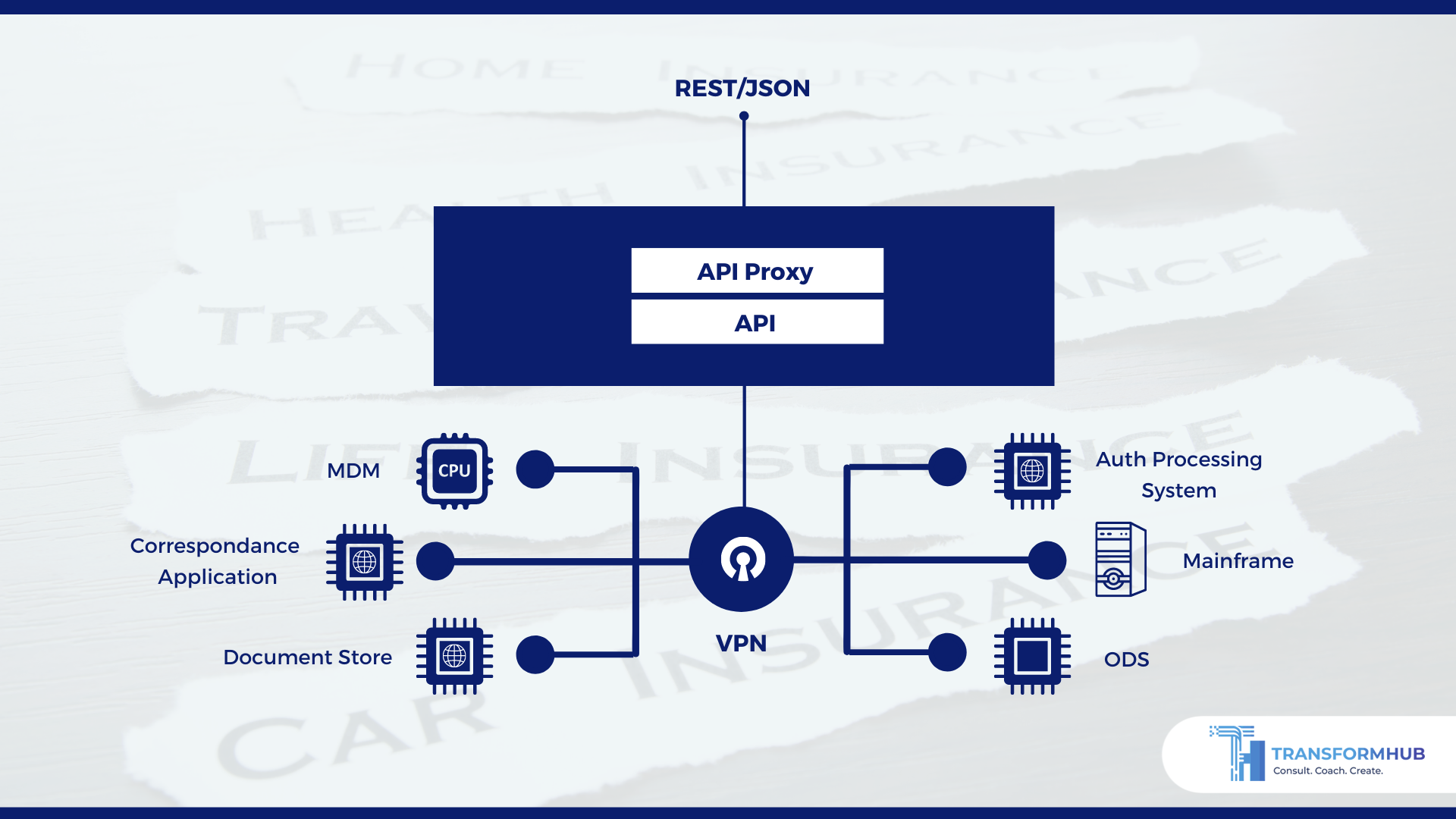

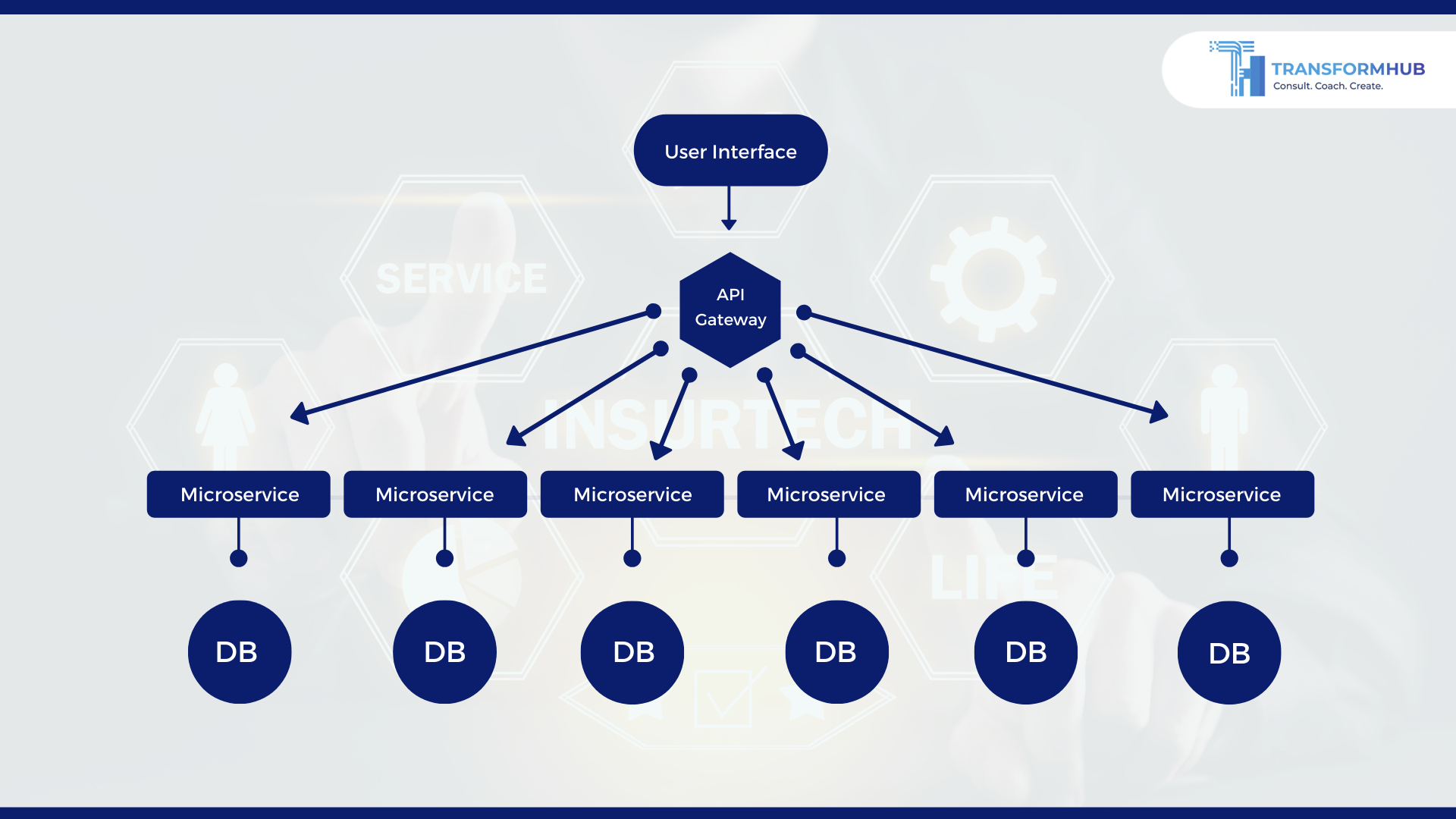

Common components (API gateway and developer portal) need to be built in a layered manner so that data traffic passes through different layers effectively. Typically, there would be a security layer, the caching layer, the representation layer, and the orchestration layer. A central, layered API architecture is just what you need for better functionality and greater security.

A survey by Funds Europe and Fundsquare iterates the role played by APIs in driving communication in the digital era. About 70% of respondents were already using APIs or were planning to do so in the next 12 months. The survey highlighted the issue of standardization to deliver a common format for data exchange across the sector. Maxime Aerts, Managing Director and Chief Operating Officer at Fundsquare elaborates, "These survey results confirm growing commitment across the asset management industry to utilizing APIs to support the secure transfer of data."

Aerts further explains, "Many firms are still committed to managing data in ‘on-premises’ databases. But this can result in data inconsistencies and reconciliation challenges in working across multiple data locations, where each database is often maintained by a different team. By centralizing this data in a common data hub – utilizing a data-as-a-service model – the user has real-time access to a centralized golden source where this data is consistent and standardized.”

The new age Insurtech companies are relying on modern technology to provide a differentiated service. They have built multiple microservices that are exposed via APIs and consumed by the user portal or admin portal and other points of consumption.

API examples in BFSI (Banking, Finance, and Insurance)

From technological giants like Amazon and Google to smaller but niche players like Uber, everyone is leveraging APIs to enhance customer engagement, increase digital revenues, and create a thriving partnership model. APIs are driving the BFSI sector too giving it a technological edge to further its business goals.

ICICI Bank recently launched the largest API banking portal in the country with close to 250 APIs to help partner companies co-create innovative solutions for customers in a fast, frictionless manner.

Deutsche Bank too scaled its infrastructure and upped its API game to align its goals in the highly unstable business environment of today. Says Dilipkumar Khandelwal, MD & Global Head of Technology Centre, Deutsche Bank, "Data continues to remain a major focus area for the bank. We realized early on that we generate a lot of data, and for good reason, but we need to ensure that this data is accessible to all platforms and employees who need it. It’s also important that data is not duplicated and moving from one system to another. In Deutsche Bank, we believe in the concept of ‘data at rest’ rather than ‘data at motion’”.

Neutrinos and eBaoTech have also partnered to provide new-age digital insurance applications and leverage the rich insurance APIs thereby accelerating innovations and fostering deeper connectivity for all concerned. Everything from quotation and underwriting to payments and claims will be handled with the help of common APIs offered by Neutrino's Low Code platform.

Domain as a service powered by API integration driving business growth and ROI

Our industry experience particularly in the Banking, Finance and Insurance (BFSI) sector gives us an edge to help our trusted customers retain their leading position. can help you From a business value standpoint too, we help you with solutions and strategies that can automate processes in no time. We take pride in our banking and finance industry solution and the approach we take to modelling legacy applications.

We recently helped one of our clients from the insurance sector who wanted to implement a microservices API approach. Through meticulous study and innovative bank and finance solutions, we could not only help them onboard new customers and service claims faster but also bring down their payment time to mere minutes. A fully digital workflow now gives them a better grip on services while significantly streamlining operating costs. We offer innovative digital transformation services and IT solutions to help you achieve growth at pace.

Our fintech solutions and enterprise application integration could help you too. Get in touch with us to allow us to review your business environment and provide us to be just the right banking solutions providing company for your business needs.

Share this

You May Also Like

These Related Stories

Buy Now, Pay Later: Opportunities and Challenges in Consumer Finance

How Can CRM be Improved with Business Intelligence Tools