Industrialisation, as we know, has been a pillar of global economic development.

Industrialised economies are robust, resilient and unwavering with high skilled resources that can compete globally.

It cannot be denied that the Middle Eastern countries have focussed on industrialisation as a crucial element for their growth and economic diversification.

- The UAE and Jordan is focussing on manufacturing to contribute to approx. 27% to their overall GDP by 2025

- Saudi Arabia, as a part of their vision 2030, has set up a National Industrial Development and Logistics Program to transform the kingdom into an industry leader

Industrialization is possible only with digitization with the help of digital transformation company.

The internet economy or digitization enables ecommerce, fintech, insure-tech to accelerate innovation and growth.

Read More:- The Future of IT in Oil & Gas | Disruption and Innovation

In the Middle East and North Africa (MENA) region, fintech is growing fast with regulators and governments considering the impact that financial technology companies can have on the broader economy.

Over the span of last decade, fintech start-ups in the region have raised over $100 million in funding, and investment was predicted to double by 2020.

Digital disruption and the Middle East

Industrialisation is expected to play a key role in driving sustainable economic growth across the Middle East.

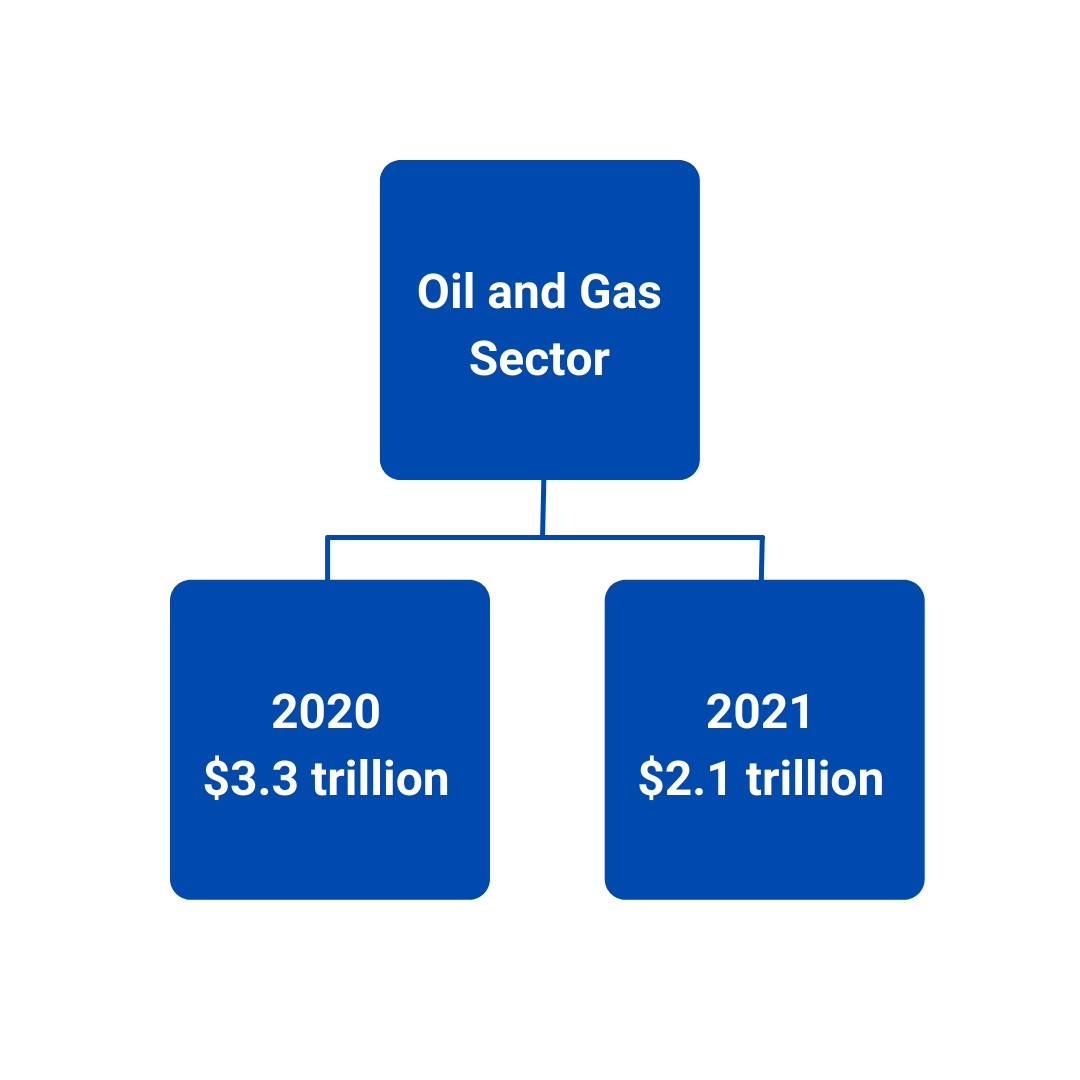

While 2020 wasn’t exactly what anyone expected, fintech software development companies in the Middle East are primed to offer ways to advance impending digital transformation in the oil and gas sector which is apparently a $3.3 trillion global energy industry, but came to a $2.1 trillion mark in 2021.

About 92% of oil and gas executives at E&Y agree that, in order to come out of the current downturn, their organizations will have to change the ways of working.

And 43% identified the overarching availability of big data analytics and insights as one of the top three trends that will positively impact the business.

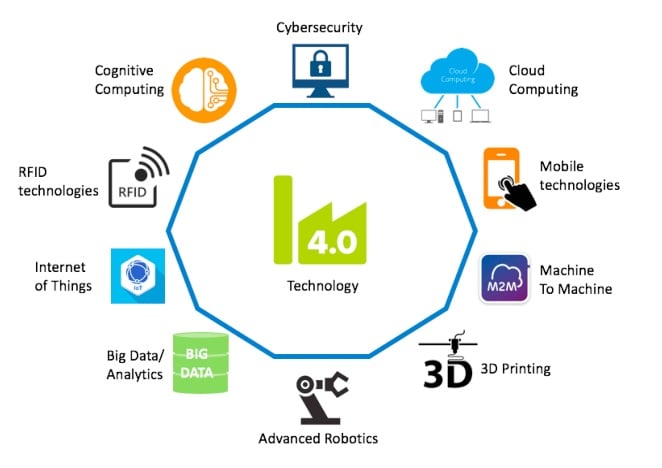

The report also states that the companies are evaluating digital technologies to drive production efficiencies and transforming operations to function on razor-thin margins. These technologies include:

These technologies are what TransformHub specialises in.

By connecting businesses to the right people and technology, we help them succeed.

Stifling fintech growth

According to a survey by PwC, DIFC, DFSA and governments across the region are taking a more active role in nurturing fintech infrastructure.

This is making banks respond better to fintech and invest in the ecosystem.

Many Islamic banks are investing in digital initiatives to make their operations more efficient and scalable.

Boosting financial inclusion

Financial inclusion is critical for economic diversity and growth across the region, and fintech has become an innovative way to bridge the divide and provide cheaper services to the unbanked.

Fintech focuses on solving customer challenges instead of forcing them to be banking clients, thereby giving companies the ability to run lean businesses and power to leverage a bank’s processing, issuing and acceptance systems.

In the Middle East, fintech as one of the strongest sectors of the economy, has opened up opportunities by empowering SMBs, thereby supporting Saudi Arabia’s 2030 vision that aims to reduce the dependency on oil revenues.